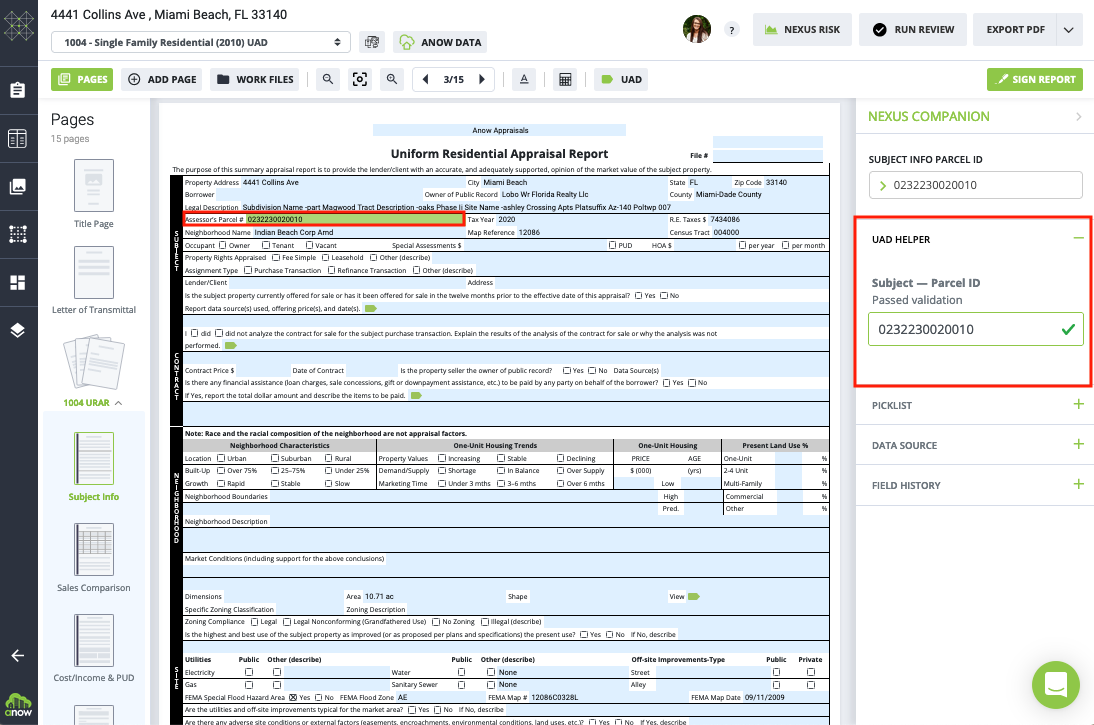

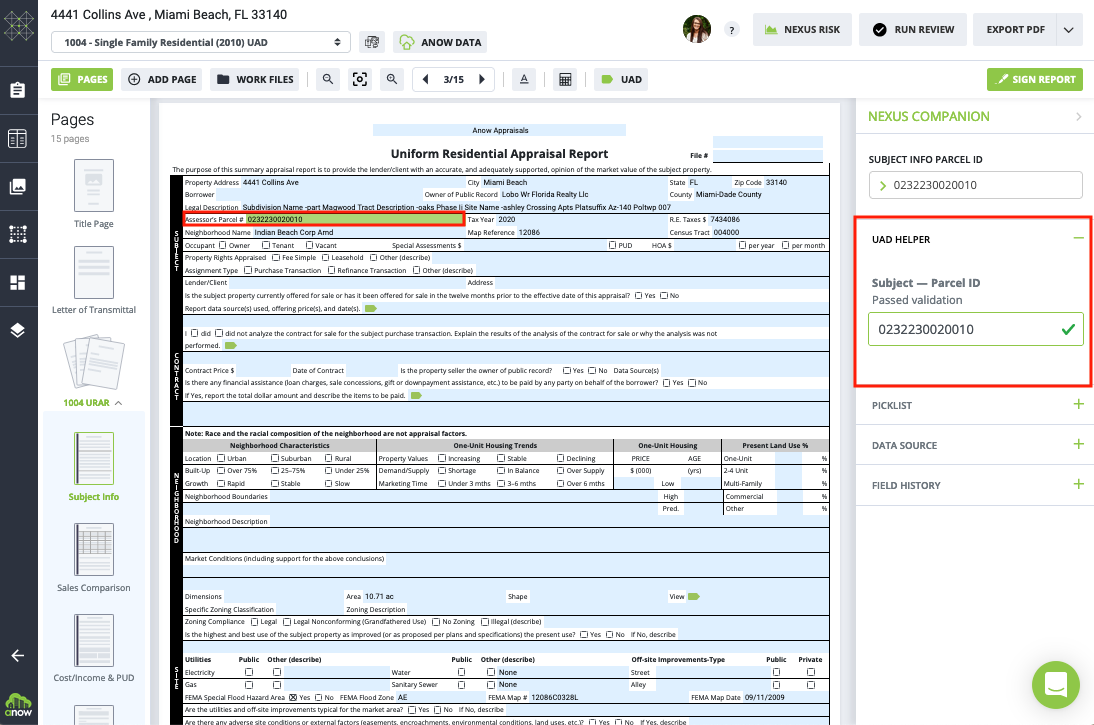

UAD – Uniform Appraisal Dataset, which is intended to standardize key appraisal data elements to promote consistency.

UMDP – Uniform Mortgage Data Program, which is a program to standardize appraisals and loan delivery data for mortgages that are purchased by the GSEs. The new changes and mandated regulations include: When implemented, the faster and easier methods of review will continue to fuel the economic crisis and financial instability of our nation. The new Uniform Mortgage Data Program (UMDP) and the Uniform Appraisal Dataset (UAD) are the beginning steps toward the automated review of individual loan packages and appraisal reports. The Uniform Loan Delivery Dataset (ULDD) requirement assures future income and “job security” to MISMO and possibly the GSEs but will generate additional cost and expense to the consumer/tax payer, as the GSEs continue to request more financial assistance from Uncle Sam to fund the changes. What is and will continue to be needed are experienced and educated underwriters and review appraisers who can recognize a reliable loan package and a credible appraisal report and make good business decisions regarding them. This is NOT the time for these types of dramatic changes in lending and appraisal quality control and delivery requirements. The failure of the Government Sponsored Entities (GSEs), lenders and investors to “follow the rules” is at the heart of the economic crisis we now find ourselves in. The United States is experiencing financial instability due to the lack of enforcement of lending guidelines and quality control of regulations and review policies that were already in place. These new requirements are in the best interests of Fannie Mae and Freddie Mac, not the American taxpayer. As every appraiser knows by now, these mandates include new methods and requirements for completing appraisal reports and for the delivery of loan packages and appraisal reports.

UMDP – Uniform Mortgage Data Program, which is a program to standardize appraisals and loan delivery data for mortgages that are purchased by the GSEs. The new changes and mandated regulations include: When implemented, the faster and easier methods of review will continue to fuel the economic crisis and financial instability of our nation. The new Uniform Mortgage Data Program (UMDP) and the Uniform Appraisal Dataset (UAD) are the beginning steps toward the automated review of individual loan packages and appraisal reports. The Uniform Loan Delivery Dataset (ULDD) requirement assures future income and “job security” to MISMO and possibly the GSEs but will generate additional cost and expense to the consumer/tax payer, as the GSEs continue to request more financial assistance from Uncle Sam to fund the changes. What is and will continue to be needed are experienced and educated underwriters and review appraisers who can recognize a reliable loan package and a credible appraisal report and make good business decisions regarding them. This is NOT the time for these types of dramatic changes in lending and appraisal quality control and delivery requirements. The failure of the Government Sponsored Entities (GSEs), lenders and investors to “follow the rules” is at the heart of the economic crisis we now find ourselves in. The United States is experiencing financial instability due to the lack of enforcement of lending guidelines and quality control of regulations and review policies that were already in place. These new requirements are in the best interests of Fannie Mae and Freddie Mac, not the American taxpayer. As every appraiser knows by now, these mandates include new methods and requirements for completing appraisal reports and for the delivery of loan packages and appraisal reports. #Uad appraisals mac

The Uniform Mortgage Data Program (UMDP) is mandated by Fannie Mae and Freddie Mac (GSEs) under the direction of their federal regulator, the Federal Housing Finance Agency (FHFA). Didn't Make It to Print, Real Estate Appraiser Independence, Real Estate AppraisersĮditor’s Note: In this opinion piece, appraiser Andy Anderson expresses what many of his colleagues are thinking about the upcoming UMDP requirements.

0 kommentar(er)

0 kommentar(er)